Mortgaging hard-earned profits due to a tax surprise can be a hard on most small business owners. Even worse is learning about money left on the table due to an unclaimed or uninformed tax deduction.

Tax surprises are completely avoidable and should be mitigated before it cuts deep into your bottom-line. In this blog, you will find tips to steer clear of unexpected tax burdens come tax season.

Frequently re-estimate tax payments:

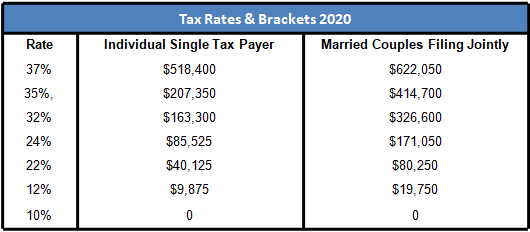

Overpaying or underpaying your taxes can abruptly hike tax figures during payments. Therefore, making it imperative to follow IRS amendments on tax rates and brackets. To accurately forecast your refund or tax payment, it is pivotal that you seek the advice of accounting experts. You can also get an estimate of your refund or owed amount via the IRS tax calculator.

Avoid losing out on deductions:

With more time invested in increasing profits, business owners often overlook potential tax deduction -turning their well-earned tax break into a tax surprise. Tax deductions can help maximize tax savings and add to your bottom line. This requires year-round planning and proper documentation to find tax deductions relevant to your business.

For 2020, business owners are eligible for new deductions under the qualified business income (QBI), some of the key takeaways are:

- No limitations on itemized deductions.

- 20% deductions of qualified business income (QBI) for pass-through businesses including sole proprietorship, partnership, S corporation, trust or estate.

- You can claim deductions on charitable deductions made to qualifying organizations.

- You can write-off salaries and benefits provided that you’re not operating as a sole proprietor, partnership or LLC, and if the salary is deemed necessary with benefits provided to employees.

- You can also deduct the cost of operating and maintaining vehicles for business transportation. Deductions are validated only if you can prove that the vehicles are used for business purposes. You can also claim standard mileage deductions under the rates issued by the IRS.

- Contributing to your retirement accounts also helps you reduce your taxable income barring that you don’t max out your contribution limit.

There are several other industry-specific deductions that you can qualify and claim. Entrepreneurs need to enlist the services of certified CPA’s who can bring value to the scores of receipts and paychecks you are holding on to.

Be diligent in filing for extensions:

Not all business owners can pay their taxes in due time. However, the IRS provision to extend provides relief to pay taxes on a periodic bases. To obtain a tax extension, it is imperative to file the right documents within the deadlines stated by the IRS. This will help you avoid failure-to-file penalties and buys your precious time to set the record straight.

Conclusion:

Tax surprises tend to dampen the morale of emerging entrepreneurs burdened with the challenge to keep their business up-and-running. Hiring a tax expert or bookkeeping professionals can help break the complexities of securing your finances against tax surprises – enabling you to focus on value-added services to further your bottom line