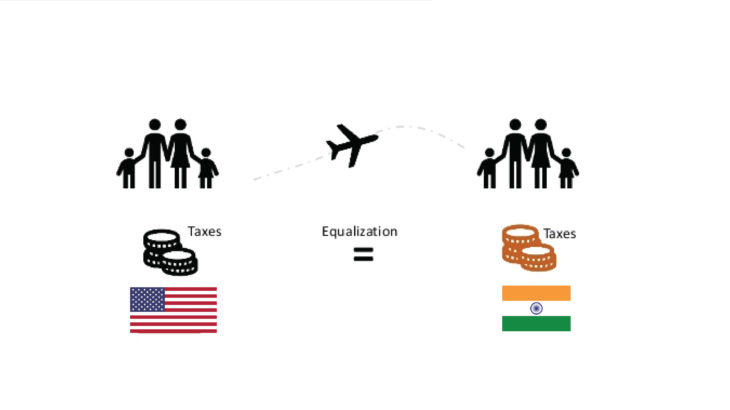

GKM specializes in double taxation and this article specifically addresses that. A U.S. expatriate is a citizen or resident of the U.S. who lives outside the U.S. and Puerto Rico for more than one year and must report 100% of their worldwide income on their U.S. individual income tax return regardless of where they […]